2024 Index finds industry performs well on policy, but lags in practice

Date

19 November 2024

Companies are maintaining comprehensive policies and promising commitments to expand access, with the Index identifying specific initiatives from several companies aimed at addressing chronic gaps in underserved regions. However, progress in the implementation of these initiatives is somewhat limited.

With the increased emphasis on assessing the outcomes of companies’ policies and practices in the 2024 Index, there has been a global decrease in performance across the 20 companies. This indicates that, although leading companies are making efforts to bridge the gap in equitable access, there is still a considerable way to go in achieving the United Nations Sustainable Development Goal of universal health coverage through equitable access to affordable essential medicines and vaccines.

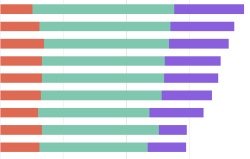

An overall industry analysis across the 15 priority topics within the three Technical Areas – Governance of Access, Research & Development (R&D) and Product Delivery – unpacks companies’ performance in more detail, revealing where companies perform strongly and where progress needs to be accelerated.

Governance of Access

Overall strong industry performance and emerging efforts to measure patient reach

As companies continue to prioritise access to medicine in LMICs within their corporate strategies, it is encouraging to see that most companies (17) now cover all therapeutic areas within their access-to-medicine strategies (14 did this in the 2022 Index). An additional company now also demonstrates direct board-level responsibility for access, bringing this total up to 17 from 16 in 2022.

While corporate policies and practices inform the activities and initiatives companies undertake to expand access to their healthcare products, it is also important to ensure that these activities are supported by processes that can measure the impact they have on patients. Consequently, for the first time, this Index iteration also assessed how companies measure and report on patient reach, finding that 19 of the 20 companies report processes and 17 publicly report the resulting numbers. While some of these processes can be further refined by, for example, considering different contexts and scenarios; working closely with partners to collect and report on-the-ground data; and improving collaboration and knowledge sharing among industry peers, these findings illustrate encouraging steps from industry.

Research & Development

Lowest performance, with biggest gap seen in product development

Beyond improving access to their existing products, companies also old the key to developing products that can address unmet healthcare needs. However, the 2024 Index finds that companies are increasingly shifting away from addressing priority R&D gaps for diseases, such as malaria and tuberculosis, which pose a disproportionate disease urden in LMICs. This is reflected by a shrinking priority pipeline (253 projects versus 367 in the previous Index) and fewer new priority R&D projects added to the pipeline (93 projects compared to 151 in the previous Index).

In addition, companies are increasingly focusing their corporate strategies and, consequently, their R&D efforts on diseases that are not covered by the Index. Industry performance on access planning varies – with 14 of 20 companies having systematic policies to plan for access for all pipeline candidates from Phase II onwards. However, only four companies – Boehringer Ingelheim, Johnson & Johnson, Merck KGaA and Takeda – were found to have implemented this policy for all late-stage candidates. Despite a high proportion of pipeline candidates having access plans in place, an increased focus on the quality and geographic scope of these access plans in the 2024 Index analysis revealed considerable gaps. Specifically, companies only plan to make their pipeline candidates available in six countries in scope on average (out of a total of 113), meaning people in many LMICs will face delays in accessing the latest innovations once they reach the market. The gap is even greater in the quality of access plans for NCDs, where less than half of plans include any additional considerations beyond commercial plans for registration.

Product Delivery

Strong efforts in health system strengthening and quality and supply, but stagnation in voluntary licensing

Companies have shown a strong performance in health system strengthening and quality and supply, with wide engagement in quality health system strengthening initiatives, and fulfilling most criteria for mechanisms to ensure continuous supply of medicines, such as managing buffer stocks and strengthening supply chains. Similarly, most companies have policies to facilitate product donations, and 11 companies are engaging in long-term donation programmes for neglected tropical diseases.

Company performance varies significantly in product registration; while several companies have demonstrated their ability to register their products in a broad number of countries, almost half of products analysed (49%, 87/179) are not registered in any of the countries with the highest disease burdens. Moreover, companies are five times more likely to register their products in an upper-middle-income country (UMIC). Similarly, companies' equitable access strategies and outcomes are skewed towards UMICs, with 61% of the products assessed still lacking access strategies in low-income countries (compared with 65% in the 2022 Index). This marginal improvement is reflective of some companies expanding coverage in the 113 LMICs covered by the Index, but still leaves many patients living in low-income countries and least developed countries without access. Encouragingly, many companies did report outcomes of their access strategies to the Index, with patient reach data shared for 74% of the access strategies assessed.

However, few companies shared the numbers of the eligible patient population, which is crucial for determining whether those in need are benefiting equitably from these access strategies.

Notably there has been a trend in companies developing and launching inclusive business models over the last five years, with wide-reaching commitments to expand access for neglected populations. However, the 2024 Index finds that the implementation of the newly established models are still in early stages, and implementation of the older, more established models is currently limited.

There are several ways in which the companies analysed in the Index can harness their vast resources, expertise and knowledge to increase the availability of their innovative products in LMICs, including in those where they do not have commercial presence. For example, voluntary licensing, particularly undertaken alongside technology transfers, can be a powerful mechanism for improving local availability in LMICs. However, companies' performance in voluntary licensing has stalled. While the 2022 Index showed companies’ willingness to engage in voluntary licensing, the number of new agreements has fallen from six in the 2022 Index to just two in the 2024 Index. This is despite the fact that seven of the 20 companies currently have products in their portfolios for which voluntary licensing would be a viable option. Notably, most companies provided evidence of at least one technology transfer initiative to local manufacturers, with leading companies engaging in multiple technology transfers and other local manufacturing capacity building initiatives; lower-performing companies have not demonstrated any evidence of such efforts.

With regards to their intellectual property strategy, 18 of the 20 companies have policies in place, whereby they agree not to file or enforce patents in low-income countries and/ or least developed countries (this stood at 17 in the previous Index). This provides greater certainty to international drug procurers and generic medicine manufacturers when planning the supply of generic products. However, no companies list patent information for all products in scope on their websites.

The road ahead: Future challenges and opportunities for access to medicine in LMICs

From pipelines to patients: Products in development that could be game-changing for global health

The 20 companies in scope of the Index are advancing innovations that could improve global health outcomes. While products are often developed for profitable markets, many are unsuited to low- and middle-income countries (LMICs). However, several pipeline candidates yield the potential in addressing communicable diseases that disproportionately affect LMICs:

Respiratory Syncytial Virus (RSV) causes 100,000 child deaths each year, 99% of which occur in LMICs. However, the recent approvals of Pfizer’s Abryvso® (maternal vaccine) and AstraZeneca/Sanofi’s Beyfortus® (infant antibody) offer new hope for prevention, with Merck’s investigational antibody clesrovimab showing promise in trials.

HIV treatment | Gilead’s long-acting injectable lenacapavir, shown to be effective in both HIV prevention and treatment, marks a potential breakthrough in combating the disease. In October 2024, Gilead licensed six manufacturers to produce affordable generics for 120 LMICs.

Tuberculosis | GSK’s ganfeborole (GSK3036656), a new antitubercular drug, targets drug-resistant TB, the leading infectious killer.

Malaria | Novartis is testing a combination of ganaplacide and lumefantrine to tackle artemisinin-resistant malaria in adults and children.

Novartis ranks as the top company for the first time, followed closely by GSK. Sanofi has newly joined the top three. Pfizer joins the top five, and Boehringer Ingelheim rises into the top ten.

Read moreCapitalising on regulatory harmonisation in Africa to broaden access in overlooked countries

After a product proves successful in clinical trials, registration through a regulatory agency serves as a critical step for access to quality assured healthcare products for patients. The 2024 Index found 43% of innovative products approved in the last five years remain unregistered in Africa. In 2024, 27 African countries ratified the African Medicines Agency (AMA) treaty – which aims to harmonise regulatory procedures and improve access to medicines. The AMA also presents an opportunity to increase clinical trials in African countries, where populations are underrepresented in research.

Accelerating efforts to reach vulnerable populations

Companies are adopting ‘inclusive business models’ (IBMs) to improve access to products for neglected populations, including those in low-income countries. In the last five years, Bristol Myers Squibb, Novartis, Novo Nordisk, Pfizer, and Sanofi have launched IBMs to address access gaps. However, implementation remains limited, and transparency on outcomes varies, making it difficult to assess impact.

As more companies adopt IBMs, it is vital that companies report progress transparently, particularly the number of patients reached, which will ensure accountability towards commitment and encourage broader adoption of these models.

Ensuring sustainable supply in countries with shifted operations

Over the past two years, some companies have shifted to third-party distribution in some African markets, largely due to economic factors. GSK has made this transition in Kenya and Nigeria, and Sanofi in Nigeria. Although this shift does not mean the companies no longer supply their products in these markets, it may impact the availability and affordability of essential medicines. The continuity of affordable access for patients now hinges on the effective implementation of this model, making it crucial for companies to streamline distribution channels and prioritise maintenance of reliable supply chains.